NEWS

Nigerian Banks to Report Accounts With ₦5 Million Monthly Transactions to Tax Authorities

Starting January 1, 2026, all Nigerian banks will be required to report customer accounts with monthly transactions of ₦5 million or more to the Federal Inland Revenue Service (FIRS) and other relevant tax authorities.

This directive is part of the 2025 Tax Reform Act, aimed at improving tax compliance, enhancing financial transparency, and expanding the country’s tax base.

The reporting requirement covers both inflows and outflows—meaning the total sum of money entering or leaving an account within a month. Once the ₦5 million threshold is reached, the bank is obligated to flag the account and send the details to tax authorities.

The measure is designed to help the government identify individuals or businesses potentially underreporting their income or evading taxes, especially within the informal sector.

Other key changes in the new tax law include:

- An increase in the personal income tax exemption from ₦500,000 to ₦800,000 annually

- Capital gains tax exemptions for the sale of primary residences

- Tax exemption on compensation payments up to ₦10 million

- A revised revenue-sharing formula for Value Added Tax (VAT) among federal, state, and local governments

While the policy is expected to boost government revenue and curb tax evasion, it has raised concerns over data privacy and the need for clear safeguards to protect customer information.

Bank customers who regularly transact ₦5 million or more in a month should be aware that their accounts will be subject to routine scrutiny by tax authorities from 2026.

Discover more from Asiwaju Media

Subscribe to get the latest posts sent to your email.

-

POLITICS2 days ago

POLITICS2 days agoChinedu Ogah Decamps from APC to ADC, Joins Coalition—Video Claims Surface Online

-

NEWS5 days ago

NEWS5 days agoNigerian Internet Fraudster Ehiremen Aigbokhan Accused of Stealing ₦460 Million Meant for Trump Inauguration

-

ENTERTAINMENT7 days ago

ENTERTAINMENT7 days agoShocking! Davido Accused of Secret Dealings That Could Ruin His Career

-

NEWS7 days ago

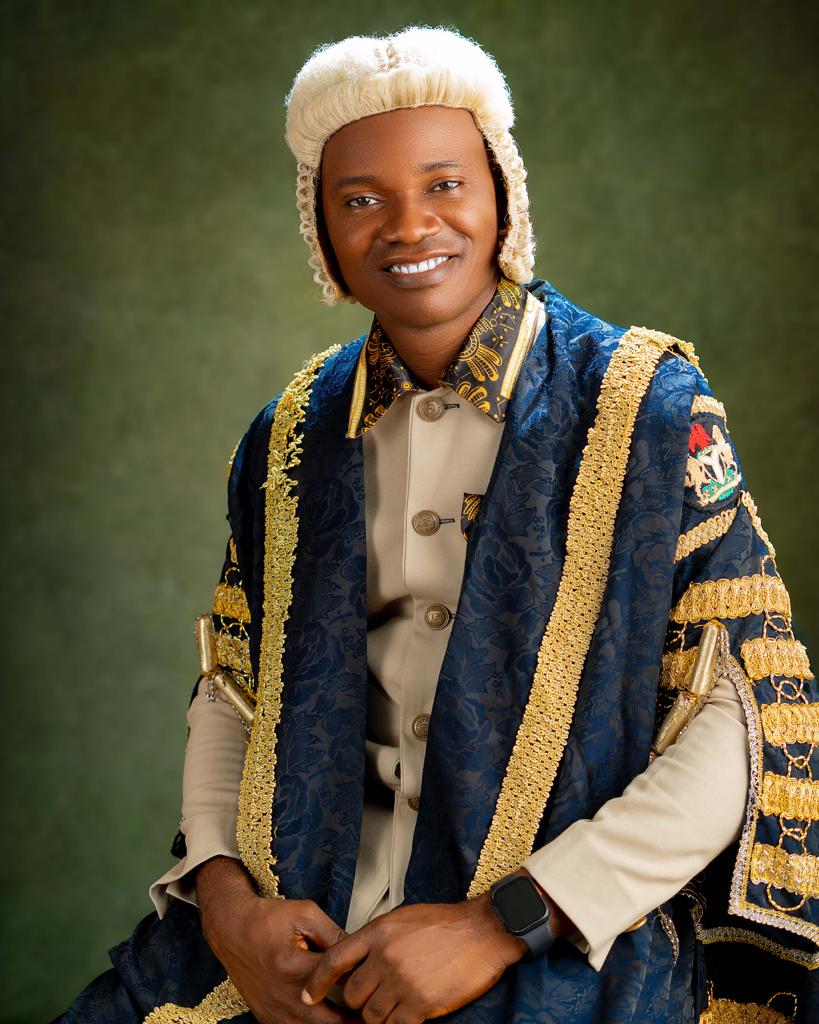

NEWS7 days agoPlateau Assembly Elects Nanloong Daniel as Speaker After Dewan’s Resignation

-

POLITICS5 days ago

POLITICS5 days agoAmaechi Wife Stole N4B Every Month, Says Wike

-

NEWS4 days ago

NEWS4 days agoEbonyi Village Lights Up with Self-Funded Electrification , Plans Road Construction

-

POLITICS4 days ago

POLITICS4 days agoADC Targets Five Governors as More PDP, APC Leaders Join Opposition Coalition

-

CAMPUS REPORTS6 days ago

CAMPUS REPORTS6 days agoAbandoned Newborn Sparks Outrage in Ikwo Community Near FUNAI Campus

-

POLITICS4 days ago

POLITICS4 days agoADC Ebonyi Welcomes Massive Influx of New Members

-

FACT-CHECKS/INVESTIGATION5 days ago

FACT-CHECKS/INVESTIGATION5 days agoTroops Neutralize Terrorists In Borno, Recovers IEDs, Weapons

-

NEWS4 days ago

NEWS4 days agoNigerian Man Captured Fighting For Russia After Serving Five Months On Battlefield

-

POLITICS4 days ago

POLITICS4 days agoEx-Jigawa Governor Lamido Says He’ll Support Peter Obi In 2027 If Coalition Picks Him