BLOG

Is Rocket Mortgage Free? Understanding the Costs Behind the Convenience

Rocket Mortgage has rapidly become one of the most recognized names in the digital mortgage space. With its fast, online-first application process and streamlined user experience, many prospective homebuyers and refinancers wonder: Is Rocket Mortgage free?

The short answer is no, Rocket Mortgage is not free. Like any mortgage lender, Rocket Mortgage charges fees and interest, although it does aim to simplify and clarify the process for borrowers. Let’s explore what using Rocket Mortgage actually costs, the fees you can expect, and whether it’s worth the investment.

What Is Rocket Mortgage?

Rocket Mortgage is an online mortgage lending platform developed by Quicken Loans, now officially known as Rocket Mortgage, LLC. It allows users to apply for a home loan or refinance online, providing real-time updates, document uploads, and digital communication with loan experts. It’s designed to make the traditionally cumbersome mortgage process more transparent and accessible.

Is There a Cost to Apply with Rocket Mortgage?

While Rocket Mortgage offers a free pre-qualification and application process, it does not mean the entire service is free. Here’s a breakdown:

- Pre-Qualification: Free. This initial step helps you understand how much you may be able to borrow based on your financial information.

- Application Fee: Typically, Rocket Mortgage does not charge an upfront application fee, but this can vary based on the type of loan and location.

- Credit Check: Rocket Mortgage will perform a hard credit inquiry when you apply, which may temporarily impact your credit score. This is standard across all mortgage lenders.

Common Rocket Mortgage Fees

Rocket Mortgage, like all mortgage providers, includes fees in its loan packages. These can include:

1. Origination Fee

This is a common fee that lenders charge to cover the cost of processing a new loan. Rocket Mortgage’s origination fee typically ranges from 0.5% to 1% of the loan amount.

2. Appraisal Fee

To ensure the home is worth the loan amount, an appraisal is required. This fee generally ranges from $300 to $600.

3. Title Services and Insurance

Title searches and title insurance protect against potential disputes over property ownership. These costs can vary depending on the property’s location but usually range from $500 to $1,000.

4. Closing Costs

These are various fees associated with the loan transaction, including taxes, government recording fees, and attorney charges. Rocket Mortgage estimates closing costs to be around 2% to 5% of the home’s purchase price.

5. Interest Payments

Like any mortgage, you will pay interest on your loan. Rocket Mortgage offers competitive rates, but they are not interest-free. The interest rate depends on your credit score, loan term, loan type, and other financial factors.

Are There Any Free Services?

Rocket Mortgage does provide some services at no additional cost, including:

- Online Loan Dashboard: Track your loan process in real time.

- Customer Support: Access to loan experts via chat, phone, or email.

- Document Uploads and Management: Digital handling of required paperwork.

These features add value without extra charges and can significantly ease the homebuying or refinancing journey.

Is Rocket Mortgage Worth the Cost?

Although Rocket Mortgage is not free, many users find its ease of use, transparency, and customer support worth the cost. Here are a few reasons why:

- Efficiency: Faster processing and approval timelines compared to traditional lenders.

- Transparency: Easy-to-understand interfaces that explain where you are in the loan process.

- Reputation: Backed by one of the largest mortgage lenders in the United States.

However, it’s always wise to compare offers from multiple lenders to ensure you’re getting the best deal in terms of interest rate, closing costs, and fees.

Final Thoughts: Is Rocket Mortgage Free?

Rocket Mortgage is not a free service, but it does offer a no-cost application and pre-approval process. Like any mortgage, the true costs are embedded in origination fees, closing costs, and interest payments. The value lies in its convenience, speed, and user-friendly experience rather than in being cost-free.

When considering Rocket Mortgage, always read the fine print, understand the full cost of your loan, and compare it to other lenders. While it may not be free, it can offer a streamlined and stress-free path to homeownership for those who value digital solutions and transparency.

Discover more from Asiwaju Media

Subscribe to get the latest posts sent to your email.

-

POLITICS1 day ago

POLITICS1 day agoChinedu Ogah Decamps from APC to ADC, Joins Coalition—Video Claims Surface Online

-

NEWS4 days ago

NEWS4 days agoNigerian Internet Fraudster Ehiremen Aigbokhan Accused of Stealing ₦460 Million Meant for Trump Inauguration

-

ENTERTAINMENT5 days ago

ENTERTAINMENT5 days agoShocking! Davido Accused of Secret Dealings That Could Ruin His Career

-

NEWS5 days ago

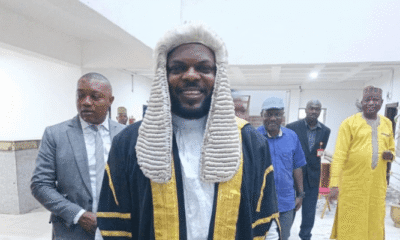

NEWS5 days agoPlateau Assembly Elects Nanloong Daniel as Speaker After Dewan’s Resignation

-

POLITICS4 days ago

POLITICS4 days agoAmaechi Wife Stole N4B Every Month, Says Wike

-

NEWS3 days ago

NEWS3 days agoEbonyi Village Lights Up with Self-Funded Electrification , Plans Road Construction

-

POLITICS3 days ago

POLITICS3 days agoADC Targets Five Governors as More PDP, APC Leaders Join Opposition Coalition

-

JOBS/SCHOLARSHIPS6 days ago

JOBS/SCHOLARSHIPS6 days agoCall For Applications: SEEDINVEST Acceleration Program For Nigerian Entrepreneurs (Up to N5 Million in Asset Grants + 6-week online Training)

-

CAMPUS REPORTS5 days ago

CAMPUS REPORTS5 days agoAbandoned Newborn Sparks Outrage in Ikwo Community Near FUNAI Campus

-

POLITICS3 days ago

POLITICS3 days agoADC Ebonyi Welcomes Massive Influx of New Members

-

INSIDE NYSC7 days ago

INSIDE NYSC7 days agoSanwo-Olu Urges 7,887 Corps Members to Tackle Unemployment with Enterprise

-

POLITICS6 days ago

POLITICS6 days agoNwifuru condemns killing of 13 Ebonyi indigenes in Anambra, vows justice