BLOG

Discover Card Student Loan Refinance: Everything You Need to Know

When it comes to managing your student loan debt, refinancing can be a powerful strategy to lower your interest rates, reduce your monthly payments, or simplify your finances. While many private lenders offer refinancing options, one name that often comes up in the personal finance space is Discover.

Known for its credit cards, Discover also provides competitive student loan refinancing services. In this comprehensive guide, we’ll explore everything you need to know about Discover student loan refinance options—how they work, the benefits and drawbacks, eligibility criteria, and whether this is the right move for your financial future.

What Is Student Loan Refinancing?

Student loan refinancing involves taking out a new loan with a private lender—like Discover—to pay off your existing student loans, whether federal or private. The new loan typically has a different interest rate, repayment term, and monthly payment structure. The goal of refinancing is usually to secure a lower interest rate, reduce your monthly payment, or shorten your loan term.

Does Discover Offer Student Loan Refinancing?

Yes, Discover offers student loan refinancing through its student loan consolidation program. This product is designed specifically for students and graduates who want to combine multiple student loans into a single, more manageable payment—ideally at a lower interest rate.

Discover’s student loan refinance program is available to graduates who meet certain eligibility requirements and can demonstrate financial responsibility. It’s important to note that Discover does not refinance student loans through a traditional “refinance loan” product, but instead provides private student loan consolidation, which functions similarly.

Key Features of Discover Student Loan Refinance

Here are the most important aspects of Discover’s student loan refinance (consolidation) program:

1. Competitive Interest Rates

Discover offers fixed and variable interest rate options. Fixed rates provide stability and predictability, while variable rates may start lower but can fluctuate over time. Rates vary depending on creditworthiness, loan term, and market conditions.

2. No Origination Fees

Unlike some other lenders, Discover does not charge any origination fees, application fees, or prepayment penalties. This can save you money upfront and over the life of your loan.

3. Flexible Repayment Terms

Borrowers can choose from terms of 10 or 20 years, depending on the amount of debt and financial goals. A longer term may reduce monthly payments but could increase total interest paid over time.

4. In-School Consolidation

Uniquely, Discover allows in-school student loan consolidation, which means you don’t have to wait until after graduation to combine your loans. This can be beneficial if you’re managing multiple loans while still attending college or graduate school.

5. Autopay Discount

Borrowers may qualify for a 0.25% interest rate reduction by enrolling in automatic payments. This discount can result in meaningful long-term savings.

Eligibility Requirements for Discover Student Loan Refinance

To qualify for student loan consolidation or refinancing with Discover, you’ll need to meet certain criteria:

- Be a U.S. citizen or permanent resident

- Be at least 18 years old

- Have an eligible degree from an accredited institution

- Meet Discover’s credit and income requirements

- Have a satisfactory repayment history on existing loans

If you don’t meet the credit requirements, you may apply with a cosigner, which could improve your chances of approval and help secure a better interest rate.

Pros and Cons of Discover Student Loan Refinance

Before refinancing your student loans with Discover, it’s important to weigh the benefits and potential drawbacks.

Pros

- No fees: Discover does not charge fees for application, origination, or prepayment.

- Flexible repayment options: Choose from fixed or variable rates and different loan terms.

- Customer service: Discover is known for 24/7 U.S.-based customer service, which adds convenience and peace of mind.

- In-school consolidation: An uncommon benefit that helps students manage multiple loans earlier.

Cons

- No co-signer release: If you apply with a cosigner, Discover does not offer a co-signer release option.

- No federal loan protections: Refinancing federal loans with Discover means losing access to federal benefits like income-driven repayment plans, deferment, forbearance, and Public Service Loan Forgiveness (PSLF).

- Limited repayment terms: Compared to some other lenders, Discover offers fewer repayment options, typically 10 or 20 years.

Should You Refinance Your Student Loans with Discover?

Refinancing with Discover could be a great choice if you have strong credit, a steady income, and primarily private student loans. It’s also an appealing option if you’re looking to simplify your payments and secure a potentially lower interest rate without paying fees.

However, if you hold federal student loans, refinancing with Discover—or any private lender—means forfeiting federal protections. If you anticipate needing benefits like income-based repayment plans or PSLF, refinancing may not be the best route.

How to Apply for Discover Student Loan Refinance

The application process for Discover student loan consolidation/refinancing is straightforward:

- Check your eligibility: Visit the Discover student loans website to review the requirements.

- Gather your documents: You’ll need information about your existing student loans, proof of income, and personal identification.

- Apply online: Complete the application, choose your repayment term, and submit supporting documents.

- Review and sign: Once approved, you’ll receive a loan agreement. After signing, Discover will pay off your existing loans and consolidate them into the new loan.

Final Thoughts

Discover student loan refinancing is a strong option for eligible borrowers who want to consolidate their student debt into a single loan with potentially lower interest rates and no fees. With its competitive terms, autopay discount, and responsive customer service, Discover stands out as a reputable choice in the refinancing space.

However, always consider your long-term financial goals and whether refinancing aligns with your overall debt repayment strategy. If federal loan benefits are crucial to you, refinancing with a private lender like Discover might not be the best fit.

Before making a decision, consider comparing multiple lenders, checking personalized rates without affecting your credit score, and consulting with a financial advisor if needed.

Discover more from Asiwaju Media

Subscribe to get the latest posts sent to your email.

-

POLITICS6 days ago

POLITICS6 days agoChristian Asaga Nwali Bags Award for Contributions to Community Development

-

ENTERTAINMENT3 days ago

ENTERTAINMENT3 days agoShocking! Davido Accused of Secret Dealings That Could Ruin His Career

-

NEWS1 day ago

NEWS1 day agoNigerian Internet Fraudster Ehiremen Aigbokhan Accused of Stealing ₦460 Million Meant for Trump Inauguration

-

CAMPUS REPORTS7 days ago

CAMPUS REPORTS7 days agoKaduna, SMEDAN Launch ₦1 Billion Fund to Power Small Business Growth

-

NEWS3 days ago

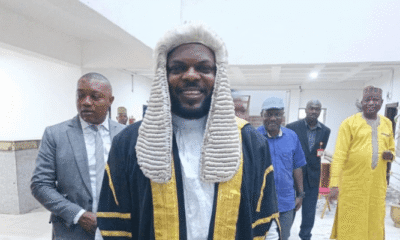

NEWS3 days agoPlateau Assembly Elects Nanloong Daniel as Speaker After Dewan’s Resignation

-

POLITICS1 day ago

POLITICS1 day agoAmaechi Wife Stole N4B Every Month, Says Wike

-

JOBS/SCHOLARSHIPS4 days ago

JOBS/SCHOLARSHIPS4 days agoCall For Applications: SEEDINVEST Acceleration Program For Nigerian Entrepreneurs (Up to N5 Million in Asset Grants + 6-week online Training)

-

INSIDE NYSC5 days ago

INSIDE NYSC5 days agoSanwo-Olu Urges 7,887 Corps Members to Tackle Unemployment with Enterprise

-

POLITICS4 days ago

POLITICS4 days agoNwifuru condemns killing of 13 Ebonyi indigenes in Anambra, vows justice

-

NEWS12 hours ago

NEWS12 hours agoEbonyi Village Lights Up with Self-Funded Electrification , Plans Road Construction

-

ECONOMY7 days ago

ECONOMY7 days agoMTN Commits ₦3 Billion to Boost Nigeria’s 3 Million Tech Talent Drive

-

SPORTS7 days ago

SPORTS7 days agoAbakaliki FC Officials Survive Highway Crash After Narrow Cup Final Loss