ECONOMY

CBN Proposes New Tech-Driven AML Standards to Combat Financial Crimes in Real Time

In a bold move to modernize anti-money laundering (AML) efforts within Nigeria’s financial sector, the Central Bank of Nigeria (CBN) has unveiled a draft framework titled “Baseline Standards for Automated AML Solutions”. The document aims to drive the adoption of cutting-edge technologies by financial institutions to detect and report suspicious transactions in real time.

The draft standards were released in a circular signed by Olubukola Akinwunmi, Director of Banking Supervision, and have been distributed to all financial institutions for feedback before finalization.

Strengthening AML Through Technology

According to the CBN, the draft is a response to the rapid digitalisation of the financial system and the emergence of complex financial products, which demand more sophisticated surveillance and compliance tools.

“CBN is committed to ensuring the integrity and stability of the Nigerian banking system,” the letter reads. “The standard is aimed at promoting operational efficiency and regulatory compliance to AML/CFT/CPF requirements by financial institutions in Nigeria.”

The proposed standards are modeled on international best practices, including recommendations from the Financial Action Task Force (FATF). They encourage the use of advanced technologies such as:

- Artificial Intelligence (AI)

- Machine Learning (ML)

- Big Data Analytics

These tools are designed to enhance the detection, prevention, and reporting of illicit financial activities with greater speed and accuracy.

Key Objectives of the Draft Standards

The draft document sets out to:

- Bolster AML/CFT/CPF frameworks through technology

- Promote real-time transaction monitoring and reporting

- Eliminate manual inefficiencies in AML processes

- Ensure alignment with domestic and global regulatory requirements

In Section 4.1, the standards mandate that AML solutions must cover:

- Risk profiling and customer due diligence

- Politically Exposed Person (PEP) and high-risk individual identification

- Risk assessment and identity verification

- Sanctions screening

- Transaction monitoring

- Automated regulatory reporting

Compliance Timeline and Enforcement

The CBN has given financial institutions 12 months from the final issuance date to implement the standards. It also stated that the apex bank will conduct industry-wide reviews and compliance assessments to enforce adherence.

Institutions are further required to provide ongoing training for AML teams on the deployment of the systems and on emerging financial crime risks.

“The CBN hereby exposes the draft Baseline Standards for Automated AML Solutions to all stakeholders and invites comments and suggestions to enrich the final version,” the circular concluded.

This move represents a significant shift toward digitally empowered financial crime prevention and is expected to unify compliance efforts, improve regulatory outcomes, and enhance Nigeria’s reputation in the global financial system.

Discover more from Asiwaju Media

Subscribe to get the latest posts sent to your email.

-

POLITICS1 day ago

POLITICS1 day agoChinedu Ogah Decamps from APC to ADC, Joins Coalition—Video Claims Surface Online

-

NEWS4 days ago

NEWS4 days agoNigerian Internet Fraudster Ehiremen Aigbokhan Accused of Stealing ₦460 Million Meant for Trump Inauguration

-

ENTERTAINMENT6 days ago

ENTERTAINMENT6 days agoShocking! Davido Accused of Secret Dealings That Could Ruin His Career

-

NEWS6 days ago

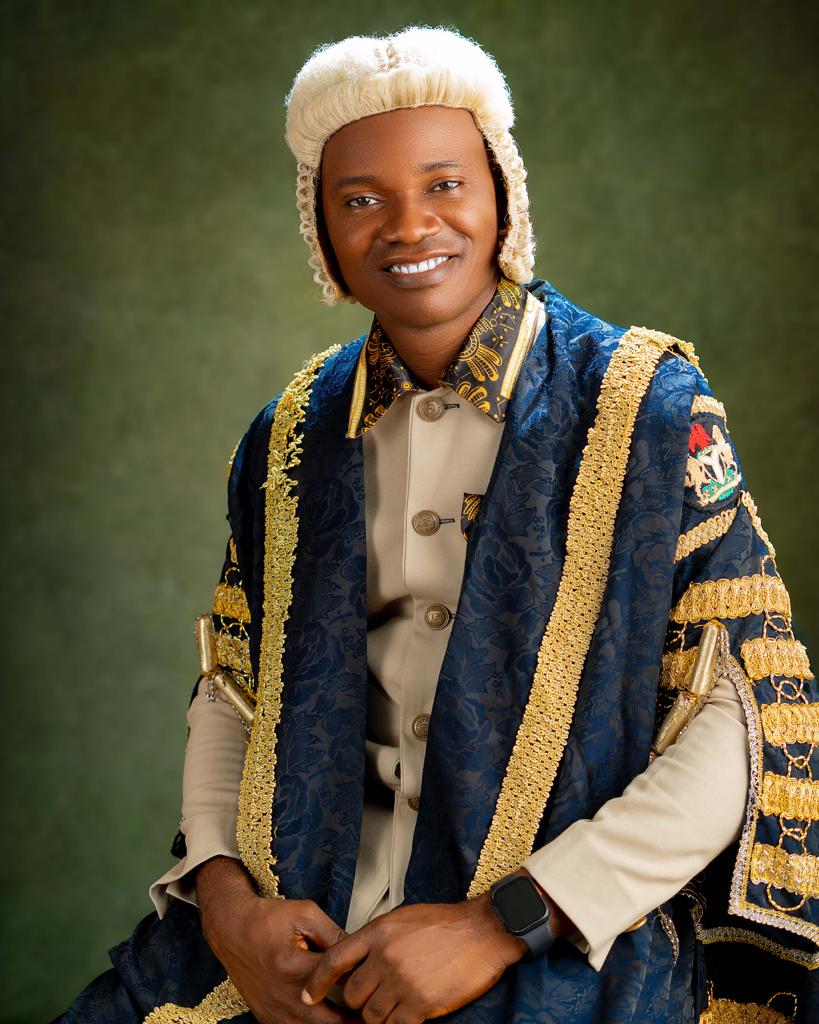

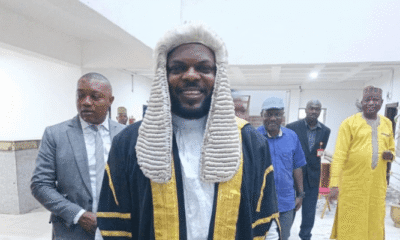

NEWS6 days agoPlateau Assembly Elects Nanloong Daniel as Speaker After Dewan’s Resignation

-

POLITICS4 days ago

POLITICS4 days agoAmaechi Wife Stole N4B Every Month, Says Wike

-

NEWS3 days ago

NEWS3 days agoEbonyi Village Lights Up with Self-Funded Electrification , Plans Road Construction

-

POLITICS4 days ago

POLITICS4 days agoADC Targets Five Governors as More PDP, APC Leaders Join Opposition Coalition

-

CAMPUS REPORTS5 days ago

CAMPUS REPORTS5 days agoAbandoned Newborn Sparks Outrage in Ikwo Community Near FUNAI Campus

-

JOBS/SCHOLARSHIPS7 days ago

JOBS/SCHOLARSHIPS7 days agoCall For Applications: SEEDINVEST Acceleration Program For Nigerian Entrepreneurs (Up to N5 Million in Asset Grants + 6-week online Training)

-

POLITICS3 days ago

POLITICS3 days agoADC Ebonyi Welcomes Massive Influx of New Members

-

FACT-CHECKS/INVESTIGATION4 days ago

FACT-CHECKS/INVESTIGATION4 days agoTroops Neutralize Terrorists In Borno, Recovers IEDs, Weapons

-

POLITICS7 days ago

POLITICS7 days agoNwifuru condemns killing of 13 Ebonyi indigenes in Anambra, vows justice